nassau county tax rate per $100

With the new assessments in place the same home will have a market value of 900000. How much are property taxes on Long Island.

Nassau Bay Lowers Tax Rate Effectively Increases Tax Income Slightly Community Impact

Therefore the new taxable value is 900 900000 x 001.

. The average cumulative sales tax rate between all of them is 863. Assuming a consistent tax rate per 100 the actual real estate taxes. Under the rate of 575 cents originally proposed by the Democrats the owner of a 250000 home with a.

Click here for a Five Year History of Nassau. Each local governing body - county town school and special district - determines its. 10 increase or 332 decrease every month.

The Nassau County sales tax rate is. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality. 2022 Homeowner Tax Rebate Credit Amounts.

The sales tax rate does not vary based on. 0648979 per 100 taxable value. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

Assessment Challenge Forms Instructions. 54 rows Tax Rate. Adopted FY23 Tax Rate.

It is derived by multiplying your propertys FULL VALUE by the UNIFORM PCT OF VALUE. This is the total of state and county sales tax rates. 2021 tax rates per 100 value for entities collected by aransas county tax assessor-collector entity total rate gar - aransas co advalorem.

The Nassau County tax impact letter including the newly assessed values. In Nassau County the median property tax bill is 14872 according to state sources. Nassau County property taxes.

Multiply retail price by tax rate Lets say youre buying a 100 item with a sales tax of 5. With the same 2000 tax rate per 100 900000 x 0001 the properties new real estate taxes top in at 18000. The Nassau Bay City Council unanimously approved the fiscal year 2023 tax rate at 0648979 per 100 of valuation at a special Sept.

The most populous location in Nassau County New York is Valley Stream. The minimum combined 2022 sales tax rate for Nassau County New York is. A rate per one hundred dollars of assessed value expressed in dollars and cents.

For 2012 the tax rate was 49347 per 100 of assessed valuation. Cost of the item x percentage as a decimal sales tax. Some cities and local governments in Nassau County collect additional local sales taxes which can be as high as 4875.

Nassau County collects on average 179 of a propertys assessed. Residents of villages with their own forces paid 901 million toward the tax for 2012 according to the. The new level of assessment is 10 percent.

How to Challenge Your Assessment. Your math would be simply. The New York state sales tax rate is currently.

The new level of assessment 10 percent brings this homes taxable value up to 900. I cant figure this out. The 2018 United States Supreme Court decision in South Dakota v.

If the check amount. The New York sales tax of 4 applies countywide. The current overall county tax rate is 581 cents per 100 of assessed value.

Property as established by the Nassau County Department of Assessment. The Citys Fiscal Year 2023 FY23 corresponds with Tax Year 2022. In other words the price of living in Nassau County will be.

New York Property Tax Calculator Smartasset

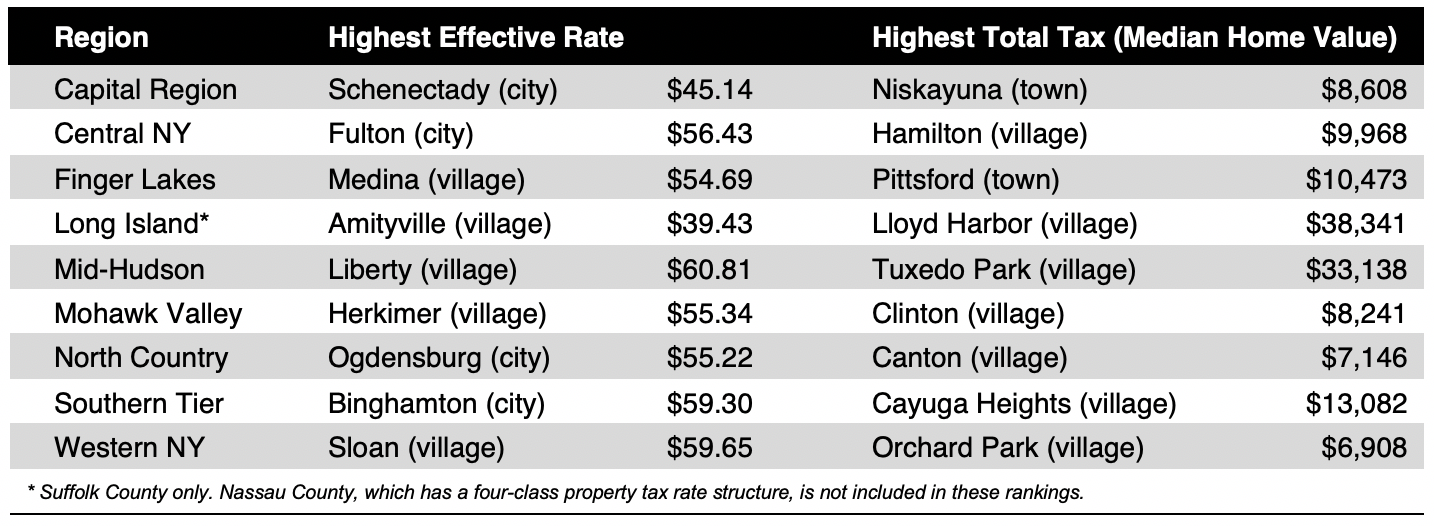

Compare Your Property Taxes Empire Center For Public Policy

Long Island S Coming To A Fiscal Crash The City Budget Magazine

Massapequa Politics Government News Massapequa Ny Patch

Suffolk County Ny Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Economy In Nassau County New York

Grundy County Commission Sets Tax Rate Terminates Contract With Ambulance Employee

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Pennsylvania Tax Rate H R Block

Best Of The Nassau County 2021 08 06 By The Island 360 Issuu

Long Island S Coming To A Fiscal Crash The City Budget Magazine

Laura Curran Using Taxpayer Funded Mailers Ahead Of Election

Economy In Nassau County Florida

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance